In today’s global economy, the logistics of shipping goods from one country to another has never been more crucial. If you’re a freight forwarding company, a logistics provider, an importer or exporter, or involved in any other aspect of the supply chain, understanding the intricacies of shipping from Argentina to New Zealand is vital. From navigating customs regulations to understanding potential surcharges, having a comprehensive guide can make all the difference.

Understanding Customs Regulations in New Zealand

Navigating customs regulations is one of the most critical steps in international shipping. New Zealand’s customs laws are designed to protect its borders while facilitating trade. It’s essential to be aware of the following key points:

First, ensure you have all necessary documentation, including commercial invoices, packing lists, and any required permits. Omitting any of these can lead to delays and additional costs.

Second, familiarize yourself with New Zealand’s Import Entry Transaction Fee (IETF), which applies to most shipments. This fee covers the cost of processing import declarations and varies depending on the shipment’s value.

Lastly, New Zealand has strict biosecurity measures in place to prevent the introduction of pests and diseases. Ensure that your goods meet these requirements, especially if you’re shipping agricultural products or food items.

Shipping Periods from Argentina to New Zealand

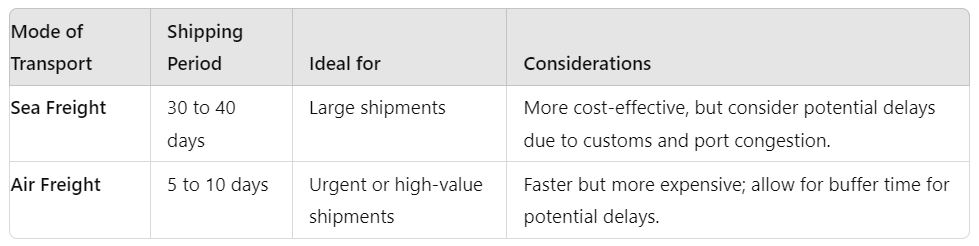

Understanding the expected shipping periods can help you plan your logistics more effectively. The transit time for shipments from Argentina to New Zealand can vary depending on several factors:

Sea freight typically takes between 30 to 40 days, depending on the specific ports involved and the shipping line used. This option is generally more cost-effective for large shipments.

Air freight, although more expensive, offers a faster alternative, with transit times ranging from 5 to 10 days. This method is ideal for urgent or high-value shipments.

Keep in mind that these transit times do not include potential delays caused by customs clearance or port congestion, so always allow for some buffer time in your planning.

Goods and Services Tax

Goods and Services Tax

Goods and Services Tax (GST) is an important consideration when shipping goods internationally. In New Zealand, GST is applied to most imported goods at a rate of 15%. Here’s what you need to know:

GST is calculated based on the Customs value of the goods, which includes the cost of the goods, shipping, and insurance. This means you’ll need to account for GST in your overall cost calculations.

It’s crucial to ensure that you have accurate documentation to demonstrate the value of your goods. Inaccurate or incomplete documentation can result in delays and additional charges.

If you’re an importer, you may be able to claim a GST refund on your subsequent GST returns. Make sure to keep detailed records of your import transactions to facilitate this process.

Remote Area Surcharge

When shipping to remote areas in New Zealand, be aware of potential surcharges that may apply. These surcharges are often imposed by carriers to cover the additional costs of delivering to less accessible locations. Here’s what to consider:

Check with your carrier to determine if a remote area surcharge will apply to your shipment. This information is typically available on the carrier’s website or through their customer service.

Factor this surcharge into your overall shipping costs to avoid any unexpected expenses. It’s better to overestimate your costs and be pleasantly surprised than to underestimate and face budget overruns.

Consider consolidating shipments when possible to reduce the per-unit cost of the surcharge. This can be particularly advantageous if you’re shipping smaller quantities on a regular basis.

Restrictions

Understanding the restrictions and regulations for shipping certain goods is crucial to avoid potential issues. New Zealand has specific restrictions on various products, including:

Prohibited items: Certain goods, such as hazardous materials, controlled drugs, and some plant and animal products, are prohibited from being imported into New Zealand. Ensure you’re aware of these restrictions to avoid legal issues.

Restricted items: Some goods require special permits or approvals before they can be imported. This includes firearms, certain chemicals, and equipment that could be used in the production of drugs.

Labeling and packaging requirements: New Zealand has specific requirements for the labeling and packaging of certain goods, particularly food and beverage products. Ensure your shipments meet these standards to avoid delays or rejections.

Frequently Asked Questions (FAQ)

Frequently Asked Questions (FAQ)

How do I calculate the total cost of shipping from Argentina to New Zealand?

To calculate the total cost, consider the following factors:

- Shipping method (sea freight or air freight)

- Customs duties and taxes (including GST)

- Remote area surcharge (if applicable)

- Handling and documentation fees

How can I ensure my shipment clears customs without delays?

Ensure you have all necessary documentation, including commercial invoices, packing lists, and any required permits. Additionally, familiarize yourself with New Zealand’s biosecurity measures and ensure your goods comply with these requirements.

What is the Import Entry Transaction Fee (IETF)?

The IETF is a fee applied to most shipments entering New Zealand. It covers the cost of processing import declarations and varies depending on the shipment’s value.

Can I claim a GST refund on imported goods?

Yes, if you’re an importer, you may be able to claim a GST refund on your subsequent GST returns. Keep detailed records of your import transactions to facilitate this process.

Are there any special requirements for shipping agricultural products to New Zealand?

Yes, New Zealand has strict biosecurity measures in place to prevent the introduction of pests and diseases. Ensure your agricultural products meet these requirements to avoid delays or rejections.

How can I reduce the cost of shipping to remote areas in New Zealand?

Consider consolidating shipments to reduce the per-unit cost of the remote area surcharge. Additionally, check with your carrier for any applicable discounts or cost-saving options.

Conclusion

Conclusion

Shipping goods from Argentina to New Zealand involves navigating a complex set of regulations, costs, and logistical considerations. By understanding customs regulations, planning for shipping periods, accounting for GST, and being aware of potential surcharges and restrictions, you can streamline your shipping process and ensure a smooth experience for your business.

Whether you’re a freight forwarding company, a logistics provider, an importer or exporter, or involved in any other aspect of the supply chain, staying informed and prepared is key to successful international shipping.

For more personalized advice and support, consider reaching out to our team or utilizing dedicated services that can help you manage the intricacies of shipping from Argentina to New Zealand. Your business’s efficiency and competitive advantage depend on it.

Goods and Services Tax

Goods and Services Tax Frequently Asked Questions (FAQ)

Frequently Asked Questions (FAQ) Conclusion

Conclusion