In the world of international trade, shipping from China to France can be a profitable yet complex endeavor. Understanding the key facets of this process is crucial. This guide aims to simplify the intricacies of shipping to France from China, providing valuable insights and practical tips to streamline your operations.

By the end of this blog post, you will have a clearer understanding of the customs regulations, shipping periods, taxes, surcharges, and logistics provider restrictions that could affect your shipments. This information will help you make informed decisions, ensuring smoother transactions and happier customers.

Understanding Customs Regulations in France

France is known for its stringent customs regulations, and it’s essential to understand these rules to avoid delays and penalties. The French customs authority, known as “Douane,” enforces strict guidelines to ensure that all imported goods comply with European Union standards.

Firstly, it’s crucial to provide accurate and complete documentation. This includes commercial invoices, packing lists, and certificates of origin. Any discrepancies can lead to significant delays and fines.

Secondly, be aware of the tariff classifications and duty rates applicable to your goods. France follows the Harmonized System (HS) code for tariff classification, and incorrect classification can result in overpayments or underpayments of duties and taxes.

Lastly, familiarize yourself with the import restrictions on certain goods. For example, items such as firearms, narcotics, and endangered species are strictly regulated and may require special permits.

Shipping Periods from China to France

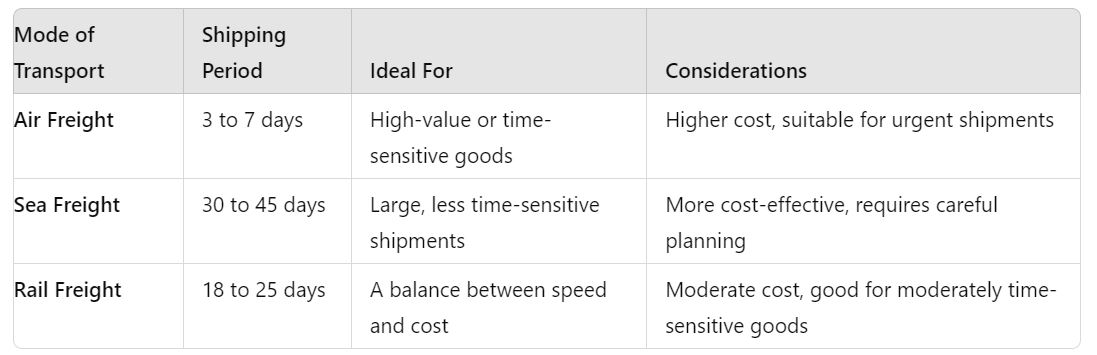

The shipping period is a critical factor in planning your supply chain. The time it takes for goods to travel from China to France can vary significantly based on the mode of transport and the specific route chosen.

For air freight, shipping periods typically range from 3 to 7 days. This method is ideal for high-value or time-sensitive goods, but it comes at a higher cost.

For sea freight, shipping times can vary between 30 to 45 days, depending on the port of origin and destination. While more cost-effective, this method requires careful planning to avoid stockouts.

It’s also worth considering rail freight as an alternative. This option offers a balance between speed and cost, with transit times ranging from 18 to 25 days.

Goods and Services Tax (GST) in France

France imposes a Value Added Tax (VAT), which is similar to a Goods and Services Tax (GST). Understanding the VAT implications of your imports is essential for compliance and cost planning.

The standard VAT rate in France is 20%, but reduced rates apply to certain goods and services. For example, food products, books, and pharmaceuticals may be subject to reduced rates of 5.5% or 10%.

Importers are required to pay VAT at the point of entry, but businesses can reclaim this tax through their VAT returns. It’s crucial to maintain accurate records and documentation to facilitate this process.

Additionally, the “reverse charge” mechanism may apply in some cases, allowing the importer to account for the VAT directly in their tax return. This can provide cash flow benefits by deferring the payment of VAT.

Remote Area Surcharge

Shipping to remote areas in France can incur additional costs known as Remote Area Surcharges (RAS). These surcharges are applied by logistics providers to cover the extra expenses involved in delivering to less accessible locations.

Identifying whether your destination falls within a remote area is essential for accurate cost estimation. Logistics companies often provide tools or lists to help determine this.

It’s also beneficial to explore alternative delivery options. For instance, consolidating shipments to a central location or using local distribution centers can help minimize RAS.

Consider negotiating with logistics providers for better rates. Long-term partnerships and higher shipment volumes can give you leverage in discussions about surcharges.

Restrictions

Choosing the right freight forwarder is crucial for smooth shipping operations. However, shipping to France involves specific restrictions and requirements that you need to be aware of.

Firstly, understand the size and weight limitations imposed by French regulations. Exceeding these limits can result in additional charges or refusal of service.

Secondly, review the list of prohibited or restricted items in France. Ensure that your goods comply with these restrictions to avoid complications.

Finally, consider the provider’s experience and network in France. A provider with extensive knowledge of French regulations can offer valuable insights and support throughout the shipping process.

Frequently Asked Questions (FAQ)

What documents are required for customs clearance in France?

To ensure a smooth customs clearance process, you will need to provide several key documents:

- Commercial Invoice: A detailed invoice that includes the value, quantity, and description of the goods.

- Packing List: An itemized list of the products in each shipment.

- Certificate of Origin: A document that verifies the country where the goods originated.

- Bill of Lading or Airway Bill: Proof of shipment and receipt of goods.

- Import Licenses or Permits: Special permits may be required for certain restricted goods.

How can I avoid delays in shipping from China to France?

To avoid delays, ensure all documents are accurately completed and submitted. Familiarize yourself with import restrictions and classifications to avoid any issues during customs inspections. Additionally, choose a reliable logistics provider with a strong track record in international shipping.

What are the common import restrictions in France?

Common import restrictions include items such as firearms, narcotics, and certain endangered species. These goods may require special permits or may be prohibited entirely. Always check the latest regulations to ensure compliance.

What is the standard VAT rate in France for imports?

The standard VAT rate in France is 20%. However, certain goods and services may be subject to reduced rates of 5.5% or 10%, such as food products, books, and pharmaceuticals.

How do Remote Area Surcharges (RAS) affect my shipping costs?

Remote Area Surcharges are additional costs applied to deliveries in less accessible locations. Identifying whether your destination falls within a remote area and exploring alternative delivery options can help manage these costs effectively.

Can I reclaim VAT paid on imports?

Yes, businesses can reclaim VAT paid on imports through their VAT returns. It’s important to maintain accurate records and documentation to facilitate this process. The reverse charge mechanism may also apply, allowing you to account for VAT directly in your tax return, providing cash flow benefits.

Conclusion

Shipping from China to France involves navigating a myriad of regulations, taxes, surcharges, and logistical challenges. By understanding these key aspects, you can streamline your operations, reduce costs, and ensure timely deliveries.

Remember, staying informed and proactive is the key to success in international trade. For more personalized advice and support, consider booking a consultation with our experts. With their extensive experience and insights, they can help you optimize your shipping strategy and achieve your business goals.

Stay tuned for more tips and updates on international shipping and logistics. Happy shipping!